According to the provisions in the loan agreement, retained earnings available for dividends are limited to $20,000. Companies formally record retained earnings appropriations by transferring amounts from Retained Earnings to accounts such as “Appropriation for Loan Agreement” or “Retained Earnings Appropriated for Plant Expansion”. Even though some refer to retained earnings appropriations as retained earnings reserves, using the term reserves is discouraged.

Revenue vs. Retained Earnings: What’s the Difference?

Retained earnings act as a reservoir of internal financing you can use to fund growth initiatives, finance capital expenditures, repay debts, or hire new staff. Before discussing where retained earnings fall on the balance sheet, it is crucial to understand what they are. It is easier to understand what retained earnings are after defining them. The decision to retain earnings or to distribute them among shareholders is usually left to the company management. However, it can be challenged by the shareholders through a majority vote because they are the real owners of the company.

- Most financial statements have an entire section for calculating retained earnings.

- External financial trends have an important influence on earnings, of course, but it is bank management that charts the course in the face of those trends and ultimately determines success.

- Retained earnings are the cumulative profit and losses of a company that has been reinvested into the business rather than being distributed as dividends to shareholders.

- For this reason, retained earnings decrease when a company either loses money or pays dividends and increase when new profits are created.

- Cash, cash equivalents, land, machinery, inventory, accounts receivable, and other assets are examples of assets.

- The SE statement includes sections that report retained earnings, unrealized gains, losses, contributed (additional paid up) capital, and stock (familiar, preferred, and treasury) components.

- In this section, we emphasize these points with reference to some of the critical strategic decisions small banks are facing today.

Retained earnings formula and calculation

Shareholders equity—also stockholders’ equity—is important if you are selling your business, or planning to bring on new investors. In that case, they’ll look at your stockholders’ equity in order to measure your company’s worth. Let’s say that in March, business continues roaring along, and you make another $10,000 in profit. Since you’re thinking of keeping that money for reinvestment in the business, you forego a cash dividend and decide to issue a 5% stock dividend instead. It shows a business has consistently generated profits and retained a good portion of those earnings.

Shareholder Equity

Ultimately, the company’s management and board of directors decides how to use retained earnings. However, it includes various stages based on the elements of the retained earnings formula. When a company conducts business, it will generate profits or losses. Retained earnings are the portion of a company’s cumulative profit that is held or retained and saved for future use. Retained earnings could be used for funding an expansion or paying dividends to shareholders at a later date.

How are retained earnings calculated?

Whatever you paid shareholders in dividends for the period will reduce the amount shown in the statement of retained earnings. It is calculated by subtracting all the costs of doing business from a company’s revenue. Those costs may https://www.bookstime.com/ include COGS and operating expenses such as mortgage payments, rent, utilities, payroll, and general costs. Other costs deducted from revenue to arrive at net income can include investment losses, debt interest payments, and taxes.

Hiring an Accountant: Before and After

As of first quarter 2015, year-over-year earnings grew 16 percent for community banks, driven by a recovery in loan growth and ongoing improvements in asset quality. Loan balances in all major categories at community banks increased year-over-year as of first quarter 2015 (see Chart retained earnings asset or liabilities 2), and noncurrent loan rates continued to trend downward (see Chart 3). It is no coincidence that revenue is reported at the top of the income statement; it is the primary driver a company’s profitability and often the highest-level, most visible aspect of a company’s analysis.

Find the best trucking accounting software for your business with our comparison guide. Read about features, pricing, and more to make the best decision for your company. This reduction happens because dividends are considered a distribution of profits that no longer remain with the company. Retained earnings are also known as accumulated earnings, earned surplus, undistributed profits, or retained income.

- Retained earnings act as a reservoir of internal financing you can use to fund growth initiatives, finance capital expenditures, repay debts, or hire new staff.

- The above definitions for the balance sheet elements clarify that retained earnings are equity.

- Any factors that affect net income to increase or decrease will also ultimately affect retained earnings.

- The RE balance may not always be a positive number, as it may reflect that the current period’s net loss is greater than that of the RE beginning balance.

- These funds are also held in reserve to reinvest back into the company through purchases of fixed assets or to pay down debt.

- Stockholders’ equity, also known as owner’s equity, is the total amount of assets remaining after deducting all liabilities from the company.

- One can get a sense of how the retained earnings have been used by studying the corporation’s balance sheet and its statement of cash flows.

- Retained earnings are affected by any increases or decreases in net income and dividends paid to shareholders.

- On a company’s balance sheet, retained earnings or accumulated deficit balance is reported in the stockholders’ equity section.

- Therefore, a company with a large retained earnings balance may be well-positioned to purchase new assets in the future or offer increased dividend payments to its shareholders.

- Understanding the starting point can help ensure that planned initiatives are consistent with available expertise and resources.

- You could have negative retained earnings if you have a net loss and negative or low previous retained earnings.

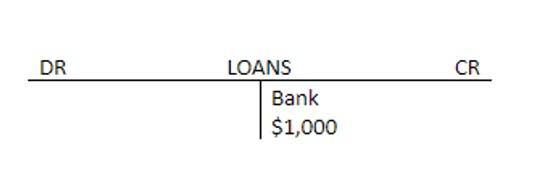

- The company posts a $10,000 debit to cash (an asset account) and a $10,000 credit to bonds payable (a liability account).

A company’s retained earnings refer to the amount of net income (or loss) accumulated since the beginning of operations minus all dividends distributed to shareholders. Undistributed earnings are retained for reinvestment back into the business, such as for inventory and fixed asset purchases or paying off liabilities. A negative balance in the retained earnings account is called an accumulated deficit.